As the pandemic first started, experts and you may service participants had been utilizing Service out-of Pros Items mortgage brokers in the over the years higher rates.

Suspicion within the pandemic has caused significant changes on the homes markets. Shedding costs and statutes one to loosened limits on the Virtual assistant home loans enjoys both lead to a nationwide increase when you look at the soldiers and you may experts using their experts.

That’s and work out a positive change into the Their state, historically a costly housing market. Into the Honolulu, Virtual assistant fund of e date a year ago. That scratching the largest increase to have a primary metro town from inside the the united states.

Low interest rates and you may the fresh laws and regulations have created another chance to have pros having in the past started priced of Honolulu’s housing market. Cory Lum/Municipal Overcome

I do not imagine people might have requested so it historical boost, said Chris Birk , director out of studies to own Experts United Home loans who has been tracking the knowledge. With the stop of your own fiscal seasons, the guy expects the fresh new numbers would be even higher.

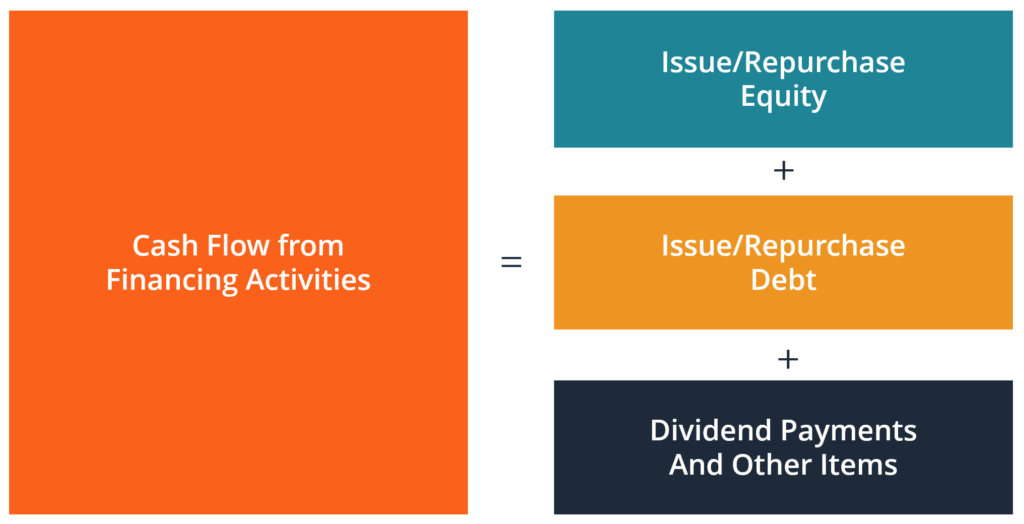

A beneficial Virtual assistant loan is a mortgage getting armed forces veterans, provider players as well as the spouses out of dead services players. The newest Virtual assistant itself does not give out finance, but factors guidelines and you may guarantees money one qualify under the system.

The new funds can be used for both to invest in and you may refinancing belongings. Inside Honolulu Virtual assistant loans having refinancing have increased 403% yet out-of just last year .

Just about every seasoned try refinancing nowadays because the that they had feel stupid to not ever, told you Elias Halvorson, an effective Honolulu Virtual assistant mortgage expert and Heavens Force veteran, noting the modern low interest rates getting fund.

The newest Rules

All the condition on You.S. features loans Selmont West Selmont AL a compliant loan maximum, which is a cap on the size of a loan that the us government will ensure. Financing over this maximum are known as jumbo money.

Until recently, when the a house rates is actually over the county mortgage limit the customer needed to make a twenty five% down payment.

Any of these anybody you can expect to be able to get a home, was basically employed and you may to make sufficient currency, but may not have got adequate cash on hand making one to down-payment, Birk told you.

During the 2019 the compliant mortgage limit to possess just one family members product when you look at the Honolulu was $726,525. This new Blue-water Navy Vietnam Pros Operate out of 2019, which took perception at the beginning of 2020, removed mortgage constraints.

On the the latest laws, Va Money don’t need mortgage insurance otherwise off payments even if that loan is over the brand new state limitation. Which is an issue during the Hawaii, probably one of the most expensive housing avenues in the nation.

Honolulu has already established the most significant upsurge in Va financial play with of any big urban area city on the 2020 financial year. Veterans Joined

Just last year property charges for children domestic to the Oahu strike a record high . But according to Zillow, Honolulu home values enjoys refused 1.8% for the past year and Zillow forecasts they’re going to slide step 3.4% in the next 12 months.

Halvorson noted if you are looking at casing prices, a decline of some percent makes no difference in a good lay such as for instance Texas where home values become all the way down. However in Hawaii, actually hook fluctuation can indicate thousands of dollars.

Halvorson said the guy knowledge an extensive mixture of some one making use of gurus. Either its solution professionals stationed into the Hawaii exactly who pick a home sometimes since the a financial investment or wishing to lay out sources. Anybody else was retired people deciding to create a new come from the fresh isles.

A noteworthy group is actually veterans off The state employing advantageous assets to go back home. Hawaii and you may Pacific Island regions provides historically highest recruitment pricing. From inside the a survey exploring 2003 recruiting data, Native Hawaiians and you can Pacific Islanders were overrepresented regarding the U.S. Armed forces from the 249% compared with other ethnic organizations.

A lot of it is knowledge, Halvorson said, detailing that army tend to does not share with pros the gurus they really be eligible for as they transition to civil life. This is the best financing available, he additional.

Future Home

For many years rising rents and home values, also the large cost-of-living, provides inspired of numerous regarding the islands .

Joining the military has been one of the ways to own young adults in order to one another exit and get a constant salary. Now for particular veterans, the advantages bring a way back home.

I’ve however come across an abundance of people who get back and you can should make a good investment in the a location on their own and you may the ohana, told you Halvorson.

Predicated on Virtual assistant data away from 2016, Ca met with the high amount of Pacific Islander veterans followed closely by The state, Pacific Isle territories and Texas. Getting Western Western veterans the big cities out-of home were California, The state, Virginia and Arizona state.

What exactly is intriguing and pleasing is that millennial veterans are extremely operating so it rise in Honolulu, Birk noted. Orders because of the millennial experts in the Honolulu try right up twenty two% out-of last year, when you’re millennial veteran resident refinances is actually upwards 659%.

Ca and you can Hawaii are definitely the states to your large ratio from Far-eastern American and you can Pacific Islander experts. Courtesy: You.S. Navy/2009

But Birk cautioned that just since the a veteran qualifies to own a good financing that does not mean they want to carry it. Not all the pros features a constant adequate financial or existence state so you can commit to a house.

Prior to the new pandemic, unemployment is actually on the rise to have article-9/eleven veterans, making the idea of to purchase a property out-of-reach. The statutes got rid of Va financing limitations, but not the duty to settle the fresh financing.

When you’re millennials try taking out fully Virtual assistant money on the highest amounts, for each age group is actually watching notable grows. Age group X’s financing usage are upwards 215% into the Honolulu and you will Baby boomers are up 211% with regards to full financing utilization.

Instructions because of the World war ii and you can Korean Battle-point in time pros have remaining down 17% as the people generations many years, however, one to demographic nonetheless watched a growth for the refinancing that have an enthusiastic increase from 354%.

This new pandemic changed the loan process most with digital domestic tours, monitors and you can appraisals. Having said that Birk indexed that the average mortgage inside June signed for the 47 days.