Get together that have a company that enhance their characteristics and you may empower your career.

Progress is more than a directing concept, it is inserted to the towel of our own organizations 100-seasons history. Once the an effective somebody very first company, we run your own priorities. We have been dedicated to working for you build an extended-long-lasting profession that’s tricky and you may satisfying. All of the user are encouraged to try, innovate and you will expand in their own book profession path.

We realize that choice to alter work, especially throughout the times of suspicion, is tough and give challenges. We become you to. But contemplate, actually during unprecedented times, the benefits of working within a company invested in their gains can provide several advantages. While section of a company that is once the committed to your ability to succeed when you are, your role will pay out-of in ways you never envisioned you’ll be able to, both skillfully and you may directly.

A reputation You are aware and you may Faith

Built into the 1909, Common away from Omaha caters to more than cuatro.six billion private consumers and you can thirty six,000 boss teams. The audience is an economically strong, family-situated providers found in the cardiovascular system away from The united states, that have good, unflinching values.

Inspired because of the home town values and you can a commitment so you can becoming in charge and you will taking care of both, Shared off Omaha Home loan goes on you to definitely legacy.

We work in an instant-paced community where changes is constant. However, there are some things that don’t changes, such our very own commitment to working seriously, morally along with respect for just one a different. Such viewpoints are at this new forefront of your society.

As to why Mutual out-of Omaha Home loan? We Value Your ability to succeed.

At the Common out-of Omaha Mortgage, working in a diverse and you can inclusive ecosystem fuels all of our creativity. The audience is purchased cultivating a host the spot where the varied opinions, perceptions, features, and you will emotions of all the employees are acknowledged.

The inner mission is not difficult: collaborating into the a common purpose of permitting all of our users having their mortgage requires. If the purpose is similar along side team, we find it’s better to interact and you may work together discover options. By the keeping that positioning, we’ve went on to do and also in.

By way of the CML University, Mutual from Omaha Mortgage is actually performing new field pathways and options to know about home loan procedures and you can control. This month-much time studies system is actually an opportunity for newest personnel to understand more and more the fresh new in’s and you will out’s of your home loan procedure and you can produce the hands-on enjoy would have to be a successful Loan Processor. Provided by all of our Head Performing Manager, Chris Leyden, the brand new CML School offers the fresh new opportunities as well as on-the-employment knowledge for the Mutual regarding Omaha Financial group. CML College or university is a superb money for these seeking to boost its knowledge, clean abreast of world criteria, otherwise develop into an alternative profession street regarding the financial community.

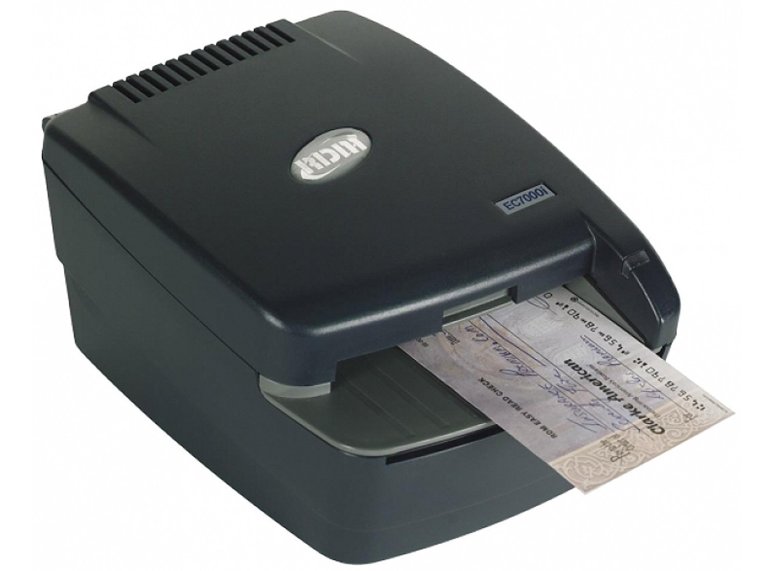

At Shared out-of Omaha Mortgage, we spouse having business frontrunners and you will innovators supply financing officials entry to complex digital tech that will amplify search engine optimization, to generate leads, reputation management, automatic social network administration and much more. The following is an example of one’s tech gadgets we make available to the originators:

Meet with the Common from Omaha Financial app – Within a few minutes, you could also provide your prospects and you may business couples that have upwards-to-day mortgage pointers, demand files, and you may fast borrowers doing 2nd procedures. Our very own application gives mortgage originators the ideal mix of highest-technology and you can highest-contact which leads in order to happy home buyers and enthusiastic referrals.

An effective CRM one to solves real problems for Birmingham loans your – Within Mutual from Omaha Financial we’ve put up an excellent CRM system one actually makes our very own financing officers’ lifestyle smoother. The CRM streamlines financing officer’s capability to realize-with several candidates and you can empowers these to easily deploy fast advertisements to meet up industry opportunities. Brilliant and you may automated wedding strategies normally smartly email address and you can text message their applicants and you will potential organization people that have some state-of-the-art workflows. This assures you don’t skip a lead or home based business.

A profits platform to manufacture borrower financial measures and present about – The loan Coach program support offer all of our mortgage officers degree and you can experience toward forefront of one’s conversion processes. It digital-built borrower transformation program can help you provide increased borrower financing recommendations to increase development.

We all know that for the majority loan officials, marketing and advertising is a thing which they want to that they had more time for you to create. After you work at Common out of Omaha Financial, i take the load out-of business from their arms and give you full use of all of our amazing group out-of marketing gurus. The Common of Omaha Financial is here now to help our very own financing officials grow its market share, boost debtor wedding, and you can cultivate dating with Realtors or any other key community couples.

- I establish you having a customized site optimized for look, highlighting your own expertise, recommendations, movies, social networking membership, and more.

- I assist take control of your social network presence by posting individualized articles and give you access to paid down social networking ads to operate a vehicle possible borrowers on the doorway.

- We provide powerful systems, particularly all of our CRM system, offering original ready-to-play with current email address, text, social media and you will printing revenue content.

- All of our top-notch films development cluster will assist you to tell your tale through quality movies that make you really excel, affect prospective individuals and you can drive wedding with your latest website subscribers.

New opinions that books our very own seasoned procedures and you may underwriting teams are dedication to a common objective. The fact that we doing a great deal more as soon as we collaborate, inside the a well-balanced and you will polite styles to greatly help your customers.

We try in order to maintain 24-hr change-to minutes for the underwriting therefore we also provide you and your subscribers that have brief answers, effective conclusion and you will productive step. Sales will always prioritized and you may closure promptly try our very own count that objective. Because of the always updating the financing programs and you can costs based on markets habits, Common regarding Omaha Home loan implies that i deliver really aggressive cost and optimal mortgage structuring.

From the Common out of Omaha Home loan, i try to ensure that our very own mortgage officials feel the service they need to be able to need a rest in place of getting their business into hold, risking the pipe or closing speed or usually needing to take a look at in on the that loan file’s progress. In regards to our cluster, work-life equilibrium is having the flexibility to find something carried out in your own top-notch life-while however with for you personally to enjoy your very own lifetime.

Jobs Opportunities

Getting a worker within Mutual regarding Omaha Financial means collaborating for the a familiar aim of providing our consumers the help of its home loan demands. Here you can perform important functions, as well as your skills could be liked and you may distinguished.