Owning a home not only will provide you with a place to make recollections with your loved ones, but it addittionally provides the capability to generate guarantee. Home guarantee is the value of your house, minus one fund you have into left equilibrium to the your property. Since you repay your home loan, your house security develops and will fluctuate according to research by the newest market value in your home.

Of numerous homeowners utilize this equity to their virtue by leveraging they so you’re able to safe property guarantee line of credit (HELOC). This means that loan providers take on your home equity once the guarantee in happening you fail to pay back any money which they provides lent your.

How do i have fun with a beneficial HELOC

House collateral credit lines was an identical design to a great mastercard. You need this line of credit and work out highest requests with money lent resistant to the collateral of your house. Once you pay off the money, their borrowing access try replenished.

Before, you could deduct so it appeal from your own fees to the as much as $100,000 regarding obligations, regardless of what you put it currency. Although not, the principles features altered due to the Income tax Incisions and you may Operate Work out-of 2017.

Is HELOC notice still tax-allowable?

According to Internal revenue service, following Income tax Cuts and you can Work Operate out-of 2017 introduced, you can just deduct focus towards the HELOC obligations if for example the currency you use is used to own renovations to your house. Put differently, for folks who buy, create, or significantly boost your house. Which ree household that you will be borrowing facing.

To help you qualify for that it deduction, the advancements you will be making on the family need certainly to improve the well worth. Repair can cost you do not matter.

Particularly, when you find yourself repainting the fresh family room otherwise removing dated wallpaper, this does not be considered. Strengthening an extension otherwise renovations the kitchen otherwise restroom are instances away from generous developments which can be taxation-allowable.

Can you imagine I’m to shop for another home?

While purchasing another family, the bucks used to buy the home need to be shielded of the next household when it comes down to appeal getting tax-deductible. If you utilize borrowing from the bank out-of a preexisting the home of pick good second domestic, this focus isnt allowable.

Just how much interest try deductible?

According to the the newest terms of the fresh Tax Cuts and you may Efforts Operate, desire is actually deductible into loans as much as $750,000 secured by the house security for many who try single or hitched submitting as one. When you find yourself partnered processing alone, the latest restriction are $375,000. So it restriction out of $750,000 is a total restrict, and thus so it takes into account extent you are borrowing for qualities.

When you yourself have a couple homes, with one or two loans protected of the house collateral, the total property value this lent money should be lower than $750,000, usually the complete focus isnt deductible. Alternatively, a portion is actually deductible considering Book 936 in the Internal revenue service.

How do i monitor HELOC taxation write-offs?

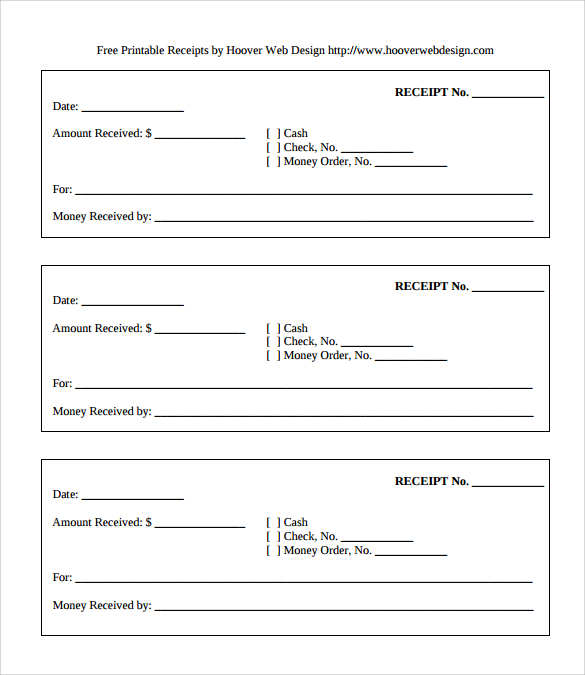

With the intention that you could potentially take advantage of all the income tax write-offs certain to your, it is vital to feel careful about remaining info of every home improvements you will be making. Speaking-to an enthusiastic accountant how best to organize this type of records can help you make sure you dont overlook any write-offs. Remaining all of your invoices is a good place to begin.

A different of use idea is to try to track all of your current lender statements. You want to be able to establish in which all of your currency went, which can be indispensable should anyone ever rating audited of the Internal revenue service. One-spot you want to sidestep is having to invest charges and you can right back fees because you do not have your own records manageable.

Additionally, it is a smart idea to keep line of credit uses ple, theoretically, you need to use a HELOC to fund one costs. It’s just these costs are not income tax-deductible. For folks who borrow funds having a great HELOC and employ half in order to buy your infant’s university fees and 1 / 2 of to fund a great home upgrade, it can rating tricky to track. It’s wise to store these types of expenditures separate, whenever we can, to be sure it is easy to song and you can prove where their currency could have been invested.

How do i allege the latest HELOC tax deduction?

Once you document their fees, you are going to itemize their deductions with the Internal revenue service Form 1040. Taking advantage of this new Freedom from HELOCs Even installment loans in Hammond Indiana if you was unable to claim their appeal because the a deduction, HELOC funds can offer dramatically reduced rates of interest and better really worth than many other streams from financing.