How Reasonable Is USDA Mortgage brokers?

The usa Company away from Agriculture (USDA) financing, called new (RD) financing, need zero down-payment that’s accessible to down-credit people.

Interest in these financing keeps growing just like the people learn their positives. Over 166,000 families utilized a great USDA loan inside the fiscal year 2015 by yourself, with respect to the department.

Visitors desire is not shocking. The new USDA loan is the only on the market today to own home buyers instead military services records.

Outlying Creativity money arrive based on located area of the possessions, not lifestyle experience. Particularly, USDA people need in order to select a house inside a beneficial rural urban area just like the laid out from the USDA. However the concept of outlying is quite liberal: throughout the 97 % of the many You.S. belongings mass is eligible.

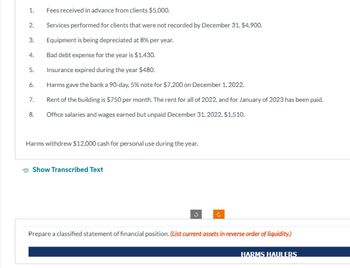

USDA Prices And you will Mortgage Insurance policies

USDA financing allow it to be 100% funding, meaning zero deposit is necessary. For the reason that USDA financing was insured, or supported, of the You.S. government.

No down payment does not mean people shell out higher costs. USDA funds provide comparable otherwise lower costs than exists that have FHA otherwise conventional loans.

USDA funds, not, keeps a little disadvantage as compared to Conventional 97 for the reason that they have an initial percentage of 1.00% of your own amount borrowed. The price isn’t needed inside the dollars at closing. As an Victor Colorado cash advance alternative, the amount try covered with the principal harmony and repaid through the years.

USDA Costs Compared to the FHA and you can Traditional 97

The point that USDA funds do not require a down payment preserves the new household client a hefty matter initial. So it decreases the timeframe it takes a buyer so you’re able to end up being willing to buy property.

Other lower-down payment solutions, eg FHA money otherwise a normal 97, still want a deposit out of 3.5% and you can 3% correspondingly.

On the average home price of on $250,000, an effective USDA debtor would want $8,750 less upfront than simply an enthusiastic FHA borrower.

USDA financing include a higher balance, because of reasonable deposit, but that’s slightly counterbalance from the straight down cost and much more reasonable mortgage insurance policies.

Down-payment

- USDA: $0

- FHA: $8,750

- Traditional 97: $7,500

Amount borrowed

- USDA: $252,500

- FHA: $245,471

- Traditional 97: $242,five hundred

Monthly Principal, Appeal, And Home loan Insurance rates

- USDA: $step 1,280

- FHA: $step 1,310

- Traditional 97: $step one,385

Remember that this type of payments dont are other can cost you such as for example assets taxes and you will homeowner’s insurance coverage, and are generally considering take to, and never live, pricing and ple suggests that USDA need an equivalent payment per month as compared to FHA, without having any step 3.5% downpayment.

As the USDA amount borrowed was higher due to zero downpayment, monthly payments are identical or below one other choices.

Monthly payment is far more very important than simply principal balance for many consumers. Down monthly costs make the USDA loan more affordable having household that have strict finances.

Lowest Credit rating For A good USDA Home loan

USDA lenders has actually other gurus and lowest initially and you will monthly costs. There is also flexible borrowing from the bank requirements than the almost every other financing designs.

To have a USDA loan, home buyers will simply you would like a credit history regarding 640. Fannie mae direction place minimal credit rating within 620 having a conventional 97, regardless of if loan providers usually typically place a top minimum of 640 so you can 680.

Truly the only well-known financing program which have a lowered required credit rating is actually FHA, and that just means a credit score from 580.

USDA Earnings Restrictions Make sure Availableness To have Reasonable Earners

USDA home loans are around for consumers at the or lower than particular income constraints. It guidelines is decided in place to make sure the application form is employed from the people who want to buy extremely.

But the income limitations to own an effective USDA is large. Are USDA eligible, the home consumer makes around 115% of the area’s median income. Incase a family group of five, below are the new yearly money restrictions for the majority of big parts:

Huge families are permitted and make more. Like, a family group of five or even more regarding La town makes $129,600 nevertheless qualify.

What exactly are Today’s Pricing?

Just like the USDA money are supported by the united states Institution of Farming, they offer pros one to others usually do not, such quick upfront will cost you and you may ultra-lower pricing.

The new loose conditions, effortless value and you will 100% funding provided with a USDA mortgage allow an emotional alternative to conquer.

Get an excellent USDA rate quote, which comes which have an assets and you will income qualifications view. All of the rates tend to be entry to your alive credit ratings and an effective customized payment per month imagine.

*This new money revealed above imagine a beneficial 720 credit score, unmarried house, and you will possessions in the Washington Condition. Traditional 97 PMI pricing are offered of the MGIC Ratefinder. Repayments do not include property taxes, homeowner’s insurance coverage, HOA dues and other will cost you, and generally are centered on analogy APRs which might be meant to have demostrated an evaluation, perhaps not already-available costs. Sample APRs made use of are as follows: USDA cuatro% APR; FHA step 3.75% APR; Conv. 97 4.25% Apr. Talk to a loan provider right here getting a customized rate and Annual percentage rate price.